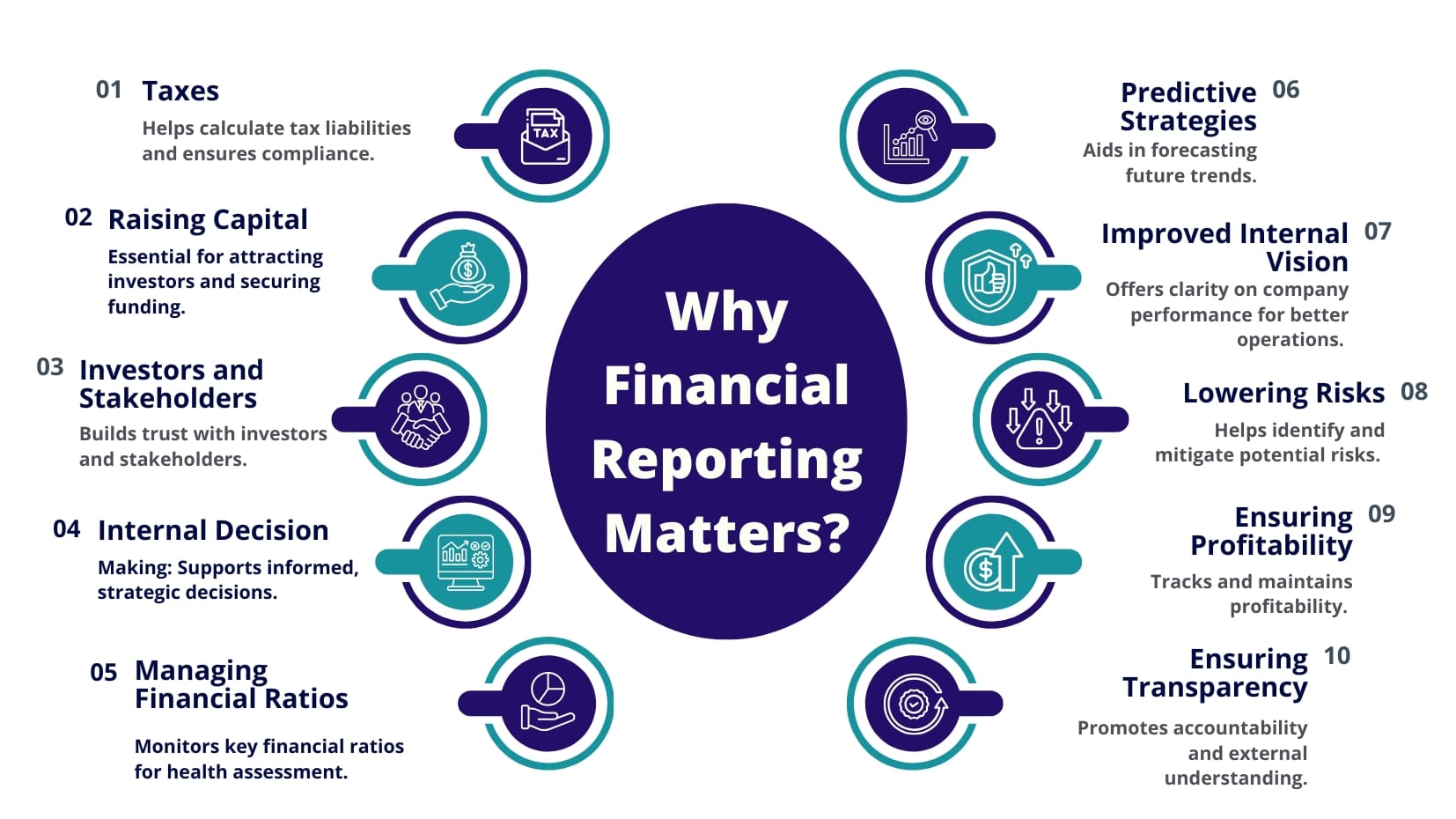

Financial reporting is crucial for ensuring transparency, compliance, and accuracy in presenting a company’s financial health. Outsourcing financial reporting enhances efficiency, expertise, and adherence to regulations, reducing operational costs. By leveraging professional services, businesses can focus on core operations while ensuring timely, high-quality financial disclosures, thereby improving credibility and strategic planning.

Core Aspects of Financial Reporting

Balance Sheet

Reflects the company's financial position by listing assets, liabilities, and equity at a specific point in time.

Income Statement

(P&L Statement)

Shows the company's profitability over a period by detailing revenues, expenses, and net profit or loss.

Cash Flow Statement

Highlights cash inflows and outflows under operating, investing, and financing activities.

Statement of Changes in Equity

Tracks changes in owners’ equity, including retained earnings and capital contributions.

Notes to Financial Statements

Details accounting policies, contingent liabilities, and any significant risks.

Management Discussion & Analysis (MD&A)

Offers a narrative from management about the company's performance, financial health, and future strategies. Discusses trends, risks, and operational highlights.

Process of Financial Reporting

Step 01

Recording Transactions

Step 02

Journal Entries

Step 03

Posting to General Ledger

Step 04

Preparation of Trial Balance

Step 05

Adjusting Entries (accruals, deferrals, etc.)

Step 06

Preparation of Financial Statements

Step 07

Internal Review

Step 08

External Audit (if required)

Step 09

Shared with Stakeholders

Unlock Clarity with Accurate Financial Reporting

Empower your business decisions with detailed and accurate financial reports. Our expert team ensures compliance, transparency, and actionable insights, giving you a clear understanding of your financial performance. Let us simplify the numbers so you can focus on what matters most—achieving your goals.