What is a Payroll?

Payroll involves managing a company’s compensation system, ensuring employees are paid their salaries, wages, and benefits accurately and punctually. Beyond issuing paychecks, it includes handling tax deductions, tracking work hours, processing bonuses, and ensuring compliance with labor laws. An efficient payroll system fosters financial accuracy, builds employee trust, and enhances organizational effectiveness.

Importance of Efficient Payroll Management

Compliance with Regulations

Adheres to federal, state, and local tax laws, avoiding costly penalties.

Employee Satisfaction

Timely and accurate payments contribute to higher morale and trust.

Financial Accuracy

Prevents errors in tax filings, deductions, and financial reporting.

Business Growth

Saves time and resources, allowing focus on strategic priorities.

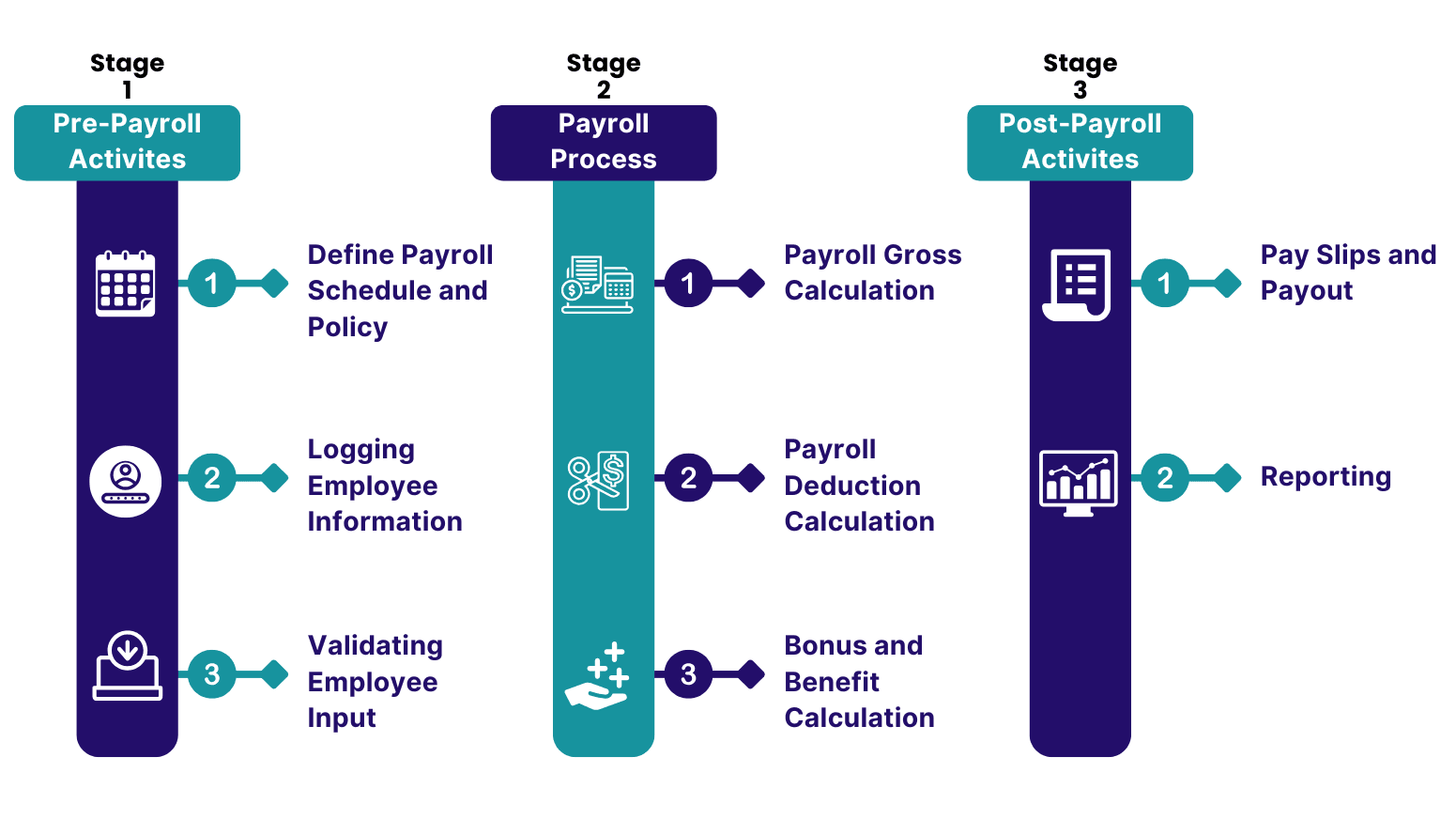

Payroll Process - 3 Stages Flowchart

Why Outsource Payroll?

Expertise & Compliance

Benefit from professionals who stay updated on payroll laws and tax regulations.

Cost-Effective

Avoid the expense of payroll software or hiring full-time staff.

Time-Saving

Free up internal resources for critical business functions.

Scalability

Easily adjust payroll services to match your business growth.

Risk Mitigation

Minimize the risk of errors, penalties, and audits with precise payroll management.

Softwares used by Building Up Ledger

Payroll Forms (country-wise)

USA

1. W-2

2. W-4

3. 941

4. 1099s

5. 940

6. State Payroll Forms

UK

1. P45

2. P60

3. P11D

Canada

1. T4

2. TD1

3. T4A

Streamline Your Payroll Process Today

Ensure Accuracy, Compliance, and Efficiency

Let our team of experts take the hassle out of payroll management. From timely payments to regulatory compliance, we handle it all so you can focus on growing your business. Contact us now to get started!