Managing sales tax, VAT, and GST returns can be challenging and time-consuming for businesses. By outsourcing these tasks to Building Up Ledger, you gain access to specialized expertise, ensuring compliance with the latest tax regulations and minimizing the risk of penalties. Outsourcing allows you to save valuable time, reduce errors, and focus on growing your business while we handle all tax filings and reporting. Our solutions are scalable to meet your needs as your business expands, and we leverage advanced technology to ensure accuracy and efficiency. With our cost-effective services, we simplify your tax responsibilities, giving you peace of mind. Reach out to us today to streamline your sales tax, VAT, and GST processes.

How to Handle These Taxes?

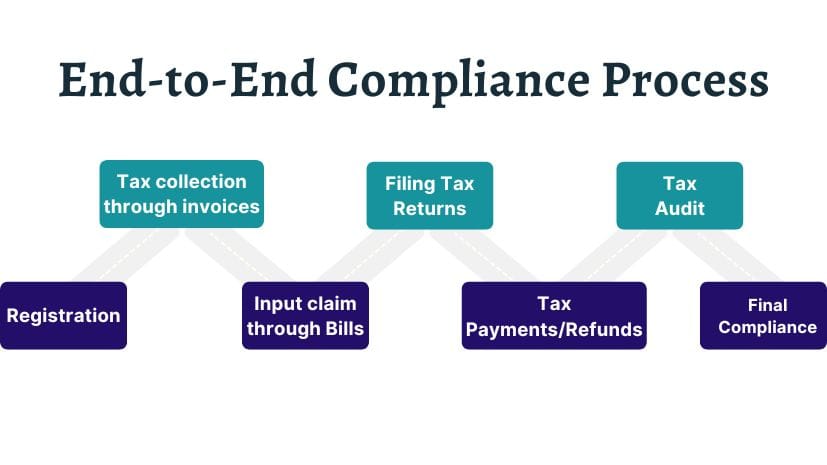

Proper Registration

Ensure your business is registered for the appropriate tax, whether it’s GST, VAT, or Sales Tax, depending on your jurisdiction and business operations.

Maintain Accurate Records

Keep detailed records of all sales, purchases, and tax payments. This is essential for claiming input tax credits and for filing returns correctly.

Timely Returns Filing

Adhere to the deadlines for filing returns to avoid penalties and interest. Many businesses file monthly or quarterly returns, with an annual summary.

Tax Planning

Understand the different tax rates that apply to the goods and services you offer, and plan accordingly to ensure compliance while minimizing liabilities.

Consult a Tax Expert

Given the complexity of indirect taxes, it’s often beneficial to consult with a tax professional or accountant who can help with tax planning, filing returns, and ensuring compliance.

Importance of Handling These Taxes Properly

- Compliance: Proper handling of GST, VAT, and Sales Tax ensures that your business complies with tax laws, avoiding legal issues, fines, and penalties.

- Cash Flow Management: By efficiently managing taxes (like claiming input credits under GST/VAT), you can optimize your cash flow and reduce the overall tax burden.

- Business Growth: Being compliant and transparent with your tax filings builds trust with regulators, which can help your business grow, especially when dealing with investors, clients, or government contracts.

- Reputation: Tax evasion can lead to severe consequences, including business shutdowns or reputational damage. Proper tax handling ensures that your business is seen as responsible and trustworthy.

Simplify Your Tax Compliance and Accelerate Business Growth

Managing sales tax, VAT, and GST can be complex and time-consuming, but with the right expertise, it doesn’t have to be. Our professional services ensure that your business stays compliant with all tax regulations while saving you valuable time and resources. Let us handle the paperwork, filings, and reporting, so you can focus on what truly matters—growing your business with confidence and efficiency.